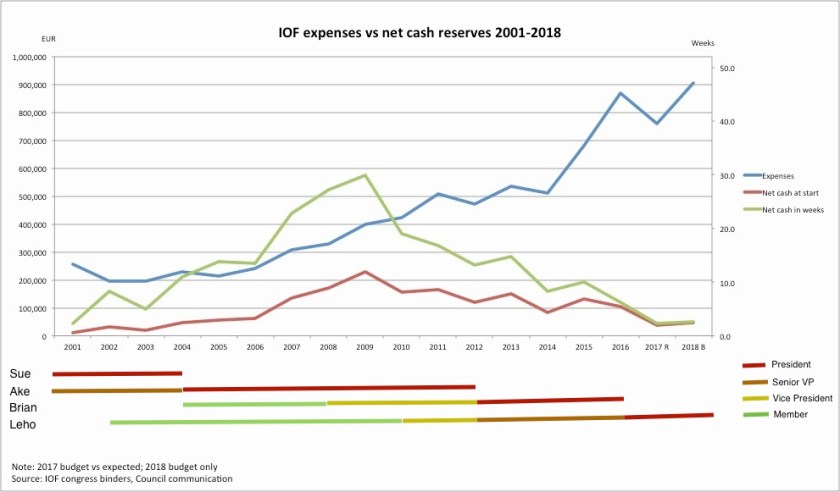

Over the past couple of days I managed to reconstruct the process how financial stability of the IOF was lost over the past couple of years. As I discussed in my previous post, IOF finances are on a knife edge. Net cash reserves are close to zero level, and debt has jumped almost ninefold from €29,000 to €252,000 in one year from end 2015 to end 2016.

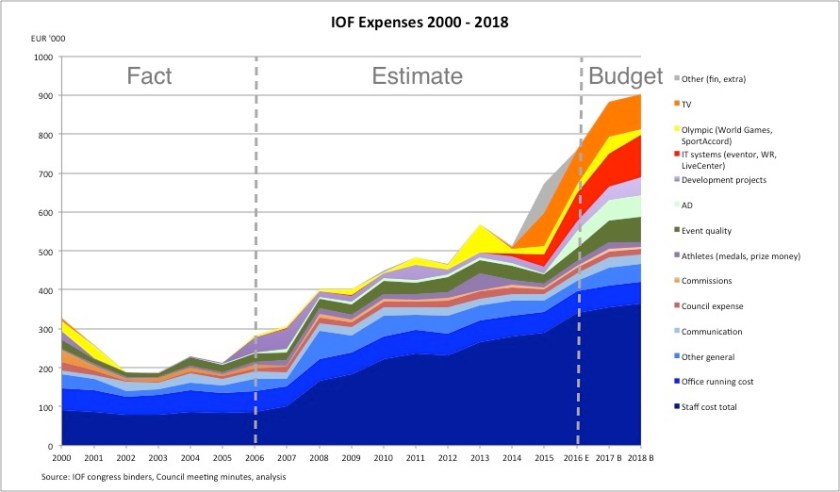

But that was not always so. A decade ago the IOF had sufficient net cash reserves to cover around half a year’s operations. Since then the combined effect of rising expenses (3 fold in 10 years!) and evaporating reserves (over 80% lost since end 2008!) has resulted in the current situation.

Financial stability has been lost for many years to come. A serious revision of the expense structure and many years of reserve building required to regain the stability the IOF enjoyed a decade ago. But that is unlikely to be delivered by a leadership involved in losing that stability.

The chart below shows how the net cash position of the IOF has decreased close to zero over the past decade due to increased costs and lower reserves. For details see the previous post. It has been adjusted for the revised 2017 forecast. Obviously, the downward revision of expenses by €100,000 was forced due to unachievable revenue targets presented to the General Assembly in August 2016.

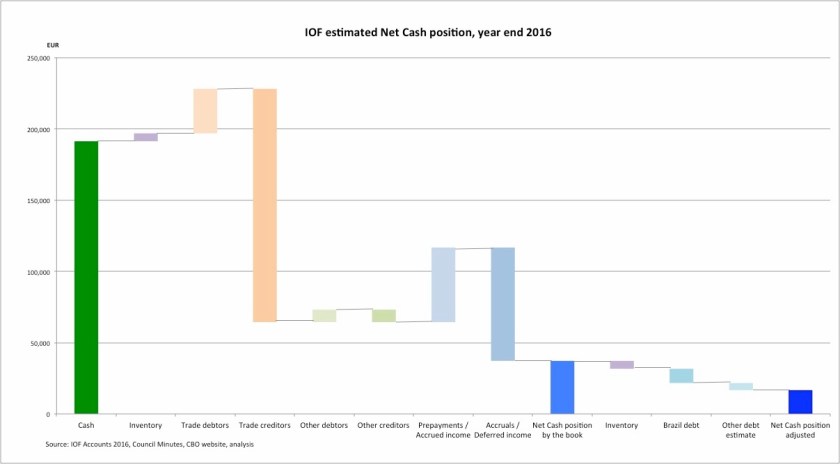

This chart shows an optimistic view of the situation. As discussed in the previous post, the actual net cash position was probably less than half of the book value at the end of 2016 due to items that were unlikely to represent cash equivalent value.

Important to note that it took a decade to build up reserves to a level that provide stability (at least half a year of expenses). It is also interesting to note that the decade long erosion of the financial position of the IOF correlates closely with the rise of the position, and thus the influence of the current and previous presidents. That may reduce the likelihood of meaningful short term adjustment of the financial strategy of the IOF.

There are three additional thoughts I would like to share on this topic:

- the importance of reserves

- the triple whammy of IOF finances

- the value of financial stability