There was an interesting point in the April 2019 Council Meeting Minutes that may be subject to some interesting discussion this week in Norway during the Foot-O World Championships and the Presidents’ Conference held in conjunction. Pity, that in contrast with previous years, no information is available in advance from the IOF’s relevant web page.

In April the Council has committed a very substantial €50,000 guarantee, or 27%, towards the CHF 200,000 cost of inclusion of Ski-O in the 2021 Winter Universiade in Switzerland. “Council agreed to offer to Swiss Orienteering a guarantee to reserve a maximum amount of 25 000 EUR from the budget in 2020 and 2021 respectively towards the inclusion of Ski Orienteering in WU 2021.” You may find all details the Council Minutes #194 on the IOF web page.

It was refreshing to see a highly unusual deviation from the unanimous voting norm within the Council. The Finnish member “raised concern about funding partner events before improving the IOF’s own event programme and asked that this be noted”. The Norwegian member “felt the amount being committed to this project was too large in relation to meeting the goal in the Strategic Directions and asked that this be noted”.

I believe that there are three questions the Presidents of Member Federations may want to discuss next week:

- Is there really extra money available for the IOF to spend?

- Does the Council have the right to introduce a new item to the approved Budget?

- Is this the most useful way to spend any extra money that may be available?

The short answers detailed below are:

- It is far from being obvious if the IOF can afford this €50,000 commitment.

- The Council has no statutory right to modify the 2020 Budget approved by the GA.

- It would take only €18,000 a year to double the Athletes Prize Money and reduce by a third the IOF tax levied on MTBO organisers, actions that would definitely benefit our sport.

The bonus question remains open: what’s the reason that FISU, the International University Sports Federation, is so close to the heart of the IOF Leadership?

Is there money to spend?

It is far from being obvious that there is money available for the IOF to make these type of commitments.

First, the 2020 Budget approved by the General Assembly does not contain any item remotely similar to this. Even the extra “Budget scenarios” that assume higher sponsor income did not include any discretionary spend for the Council.

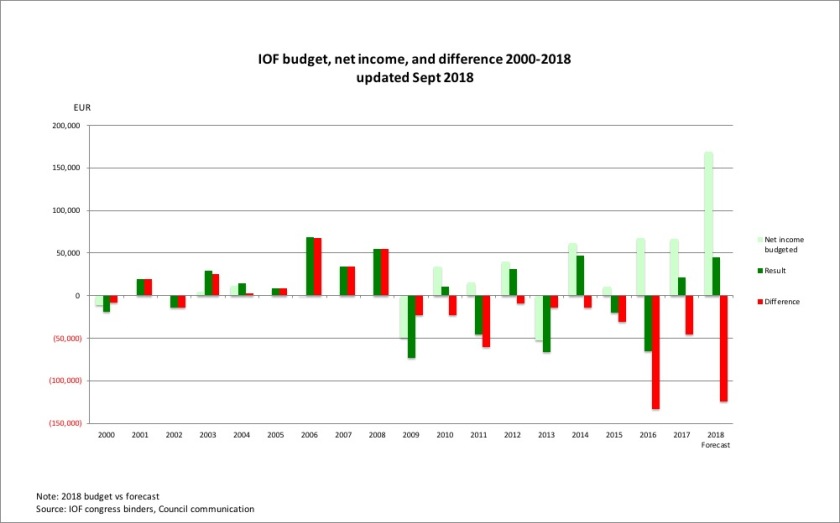

Second, in 2016, in a much better financial situation and outlook, the CEO of the IOF clearly stated that “IOF’s capital and reserves should be strengthened and that the surplus was primarily intended for this purpose” [and not for development funding]. You may read details in the 2016 GA minutes. Based on that statement of the IOF CEO, and considering the weaker financial position of the IOF after the major loss in 2016, the profit of 2018 and subsequent years should be used to stabilise the financial position.

It should be also considered that the current IOF leadership in the Financial Year of 2016 only 4 months before year end misjudged the result of the IOF by more €130,000 (the result was €65k loss instead of €67k surplus presented to the GA at the end of August). With this level of uncertainty a large financial cushion looks mandatory in the interest of the sport.

Third, not all the money shown as profit in the IOF statements may be available for spending. Although the 2018 Annual Report shows an impressive surplus of €106,054 for the year, the amount of Trade debtors has also jumped to €70,472. For the ones not familiar with accounting terminology, Trade debtors in essence shows the part of the financial results that was recorded, but cash not yet received. There are no details on the composition of this rather substantial sum, but not all of that money might be recoverable. The IOF has a track record of not being transparent when it comes to dubious debt. The best documented case is the €16,000 Brazilian debt of 2014 that was converted into a “regional development funding” in 2016 – without any transparency by the IOF. The only reason we know of this that the Brazilian Federation was more transparent than the IOF – Acordo IOF CBO – Debt Agreement Original em inglês.

Can the Council modify the Budget?

A financial guarantee is a budget item. According to the Council Minutes #194, as quoted above, the Council offered the financial guarantee of €25,000 from the 2020 Budget. The problem is that there is no expenditure item that could be used for this purposes in the 2020 Budget as approved by the General Assembly, as shown above.

According to the Statutes of the IOF, the approval of the Budget is a task for the General Assembly (Section 7.4). The Council Remit is rather broad, but does not contain any right to modify the approved Budget (Section 8.2).

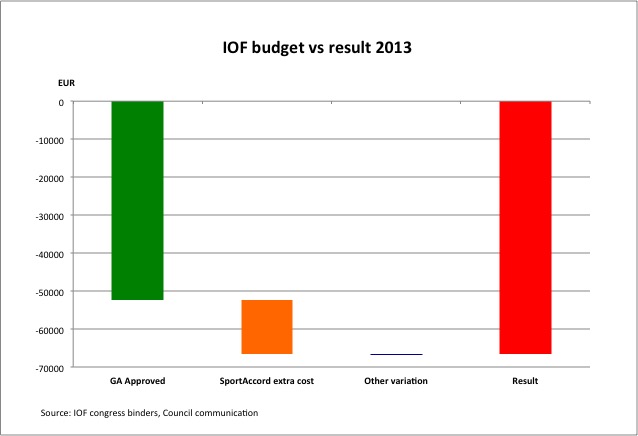

It is true, that the lack of right did not bother before the IOF leadership in modifying the approved budget. The nicest example was the modification of the 2017 Budget, when a revision of approved 2017 Budget started already in October 2016, two months after its approval.

Yet, this could result in a rather funny situation. Who will pay, if it comes to 2021 and the IOF is not capable – for whatever reason – to stand good for the €50,000 guarantee towards the Swiss organisers?

Will the guarantee be enforceable, if it was made over the budget by ones who had no right to modify the budget?

Is this the best way to spend it?

Every time one makes a financial commitment, it should be asked whether alternative spend of the monies would be more beneficial. In the months before the April Council meeting there were two causes that arguably could be more beneficial to Orienteering as a global sport than supporting the Swiss organisers of the 2021 Winter Universiade.

First, the prize money of athletes. As discussed before in my post on the Value of Athletes, the IOF Leadership shares nothing, or close to nothing, with the athletes of the hundreds of thousands of euros received from selling their performance to sponsors and through various media channels. In 2019, according to the budget above, €0 IOF contribution was planned (€9000 prize money all collected from organisers of World Cup events). According to the Special Rules for World Cup 2019 (already in deviation from the approved budget of 2019) the IOF contributes €1500 to the €12,000 prize money (the rest being collected from the organisers). So €12,000 contribution from the IOF could double the prize money.

Second, the IOF tax levied on MTBO major event organisers. The MTBO Commission asked the Council “that event sanction fees should be variable based upon IOF membership categories, citing that this would help in finding organisers of IOF events, improve quality and global development.” But “Council was not in favour of the proposal. […] The Council discussed other options for finding event organisers in MTBO such as reducing the number of events and/or reducing the program and complexity of current events.” In short, the Council would rather see a reduction in the number of 3 major competitions for MTBO athletes, than foregoing any part of the €18,000 total sanction fee collected from major MTBO events (€10k from WMTBOC and 2x€4k from World Cup organisers). Even a €6000 lower tax burden would make little change in the IOF budget, but would make substantial difference for MTBO organisers.

As shown below, the combined financial impact of the above two actions supporting many, many athletes would be much lower than the 2x €25,000 the IOF leadership is ready to hand over to the Swiss organisers of the Winter Universiade.

Why support the FISU?

The bonus question that remains hanging is about the reason why FISU is closer to the heart of the IOF Leadership than the prize money and meaningful international program for top athletes when it comes to financial support. After all, it could be considered rather surprising that the IOF is more ready to support a partner event than its own athletes and organisers.

For a long time I could not find a reasonable answer until I remembered that in 2017 the President of the IOF had to fly all the way to Taipei to collect a special prize from FISU for the “Best International Sports Federation”.

Have the Athletes Commissions or the MTBO Commission ever invited over the President of the IOF to present an Award for the ‘Best International Sport Federation’? I am afraid not.

So they should not be surprised.